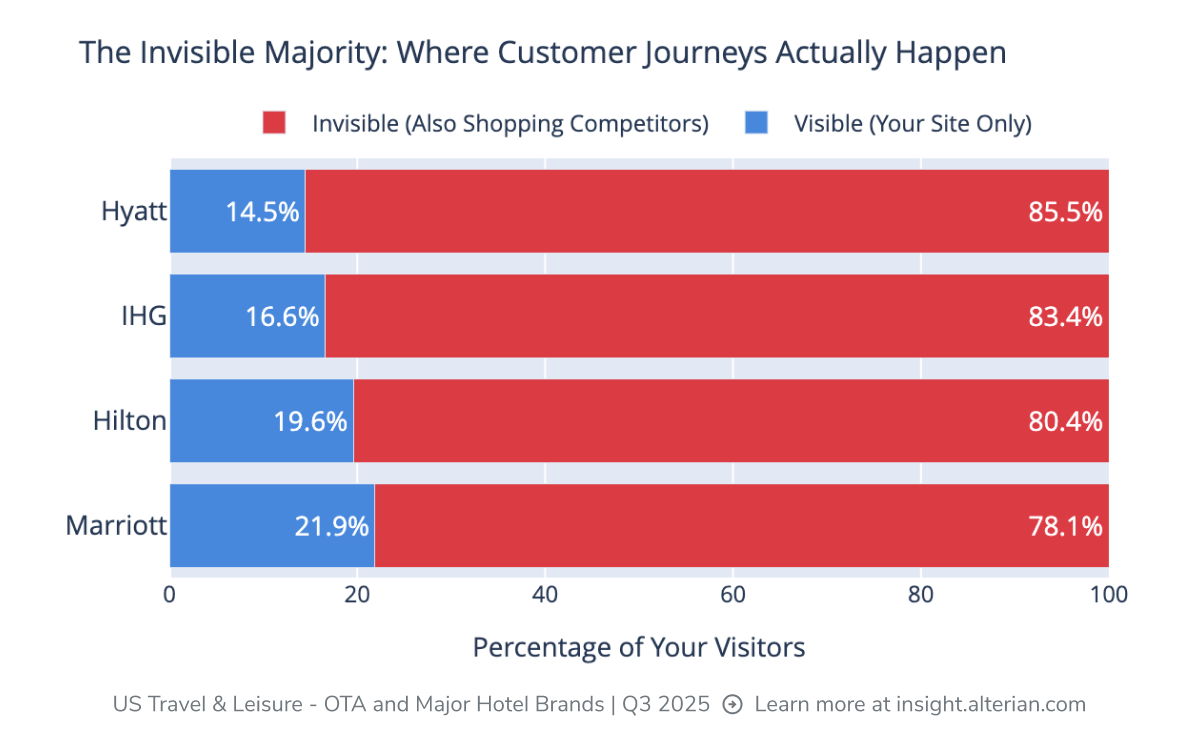

Hospitality brands can't see 85% of the customer journey

Why your best analytics still can't show you most of the customer journey

Here's what your reporting dashboard told you this quarter: conversion rates, bounce rates, time on site, campaign performance. All essential metrics. All limited to one thing: what happens on your channels.

But here's what it didn't tell you: 85% of Hyatt visitors are also browsing competitors. For Marriott, it's 78%. For Hilton and IHG, over 80%.

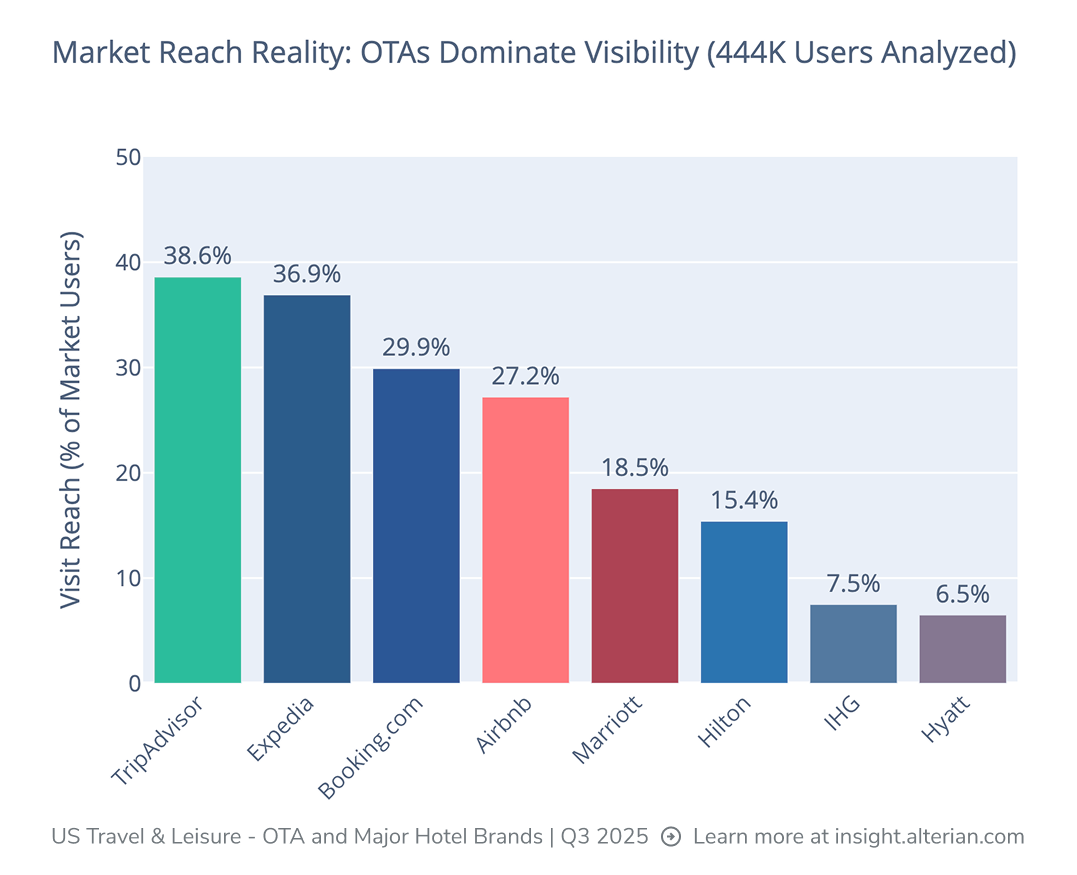

These insights come from analyzing 444,624 real users and 22.7 million on-brand customer journeys events over a 90-day period:

The majority of your customers’ activity is currently outside of your view

Your customer has changed. They're not following the ideal, linear paths you mapped out. They're comparing prices on Expedia while looking at your loyalty program. They're reading TripAdvisor reviews after clicking your ad. They're bouncing between Booking.com and your direct site multiple times before making a decision.

Online travel agents (OTAs) reach 1.5x to 6x more customers than major hotel brands

And the brutal truth? TripAdvisor reaches 172,000 travelers in this research—more than double Marriott's 82,000. Expedia touches 164,000. Your brand, regardless of how strong, is competing for attention in an ecosystem where OTAs dominate visibility.

You don't need to become a data scientist to get critical customer insights

What if you could simply ask: "Which OTA is stealing the most traffic from my direct bookings?" or "Where do my competitors' customers go after leaving their sites?" and get immediate, accurate answers backed by millions of real journeys?

That's exactly what Journey Insight does. No SQL queries. No complex dashboards. No time consuming learning curve. Just natural language questions and AI-powered insights that reveal the 85% of the hospitality customer journeys you've been missing.

The question isn't whether your customers are shopping around. The data proves they are.

The question is: what are you going to do about it when you can finally see where they're going?

Insight Copilot turns complex data analysis into an intuitive conversation

Insight Copilot prompt

Here's the exact prompt we used to surface notable insights for the Travel & Leisure market and write this blog:

Insight Copilot immediately returned these charts and explorations of competitor overlap and cross-shopping behavior for OTAs and major hotel brands. In just a few minutes, Journey Insight provided contextual, data-driven insights for the US hospitality market from a simple exploratory prompt.

What question would you ask next?

Get free insights on your customer journeys

Sign up for our robust Free Plan in just a few minutes.

See the latest CX insights

The new era of journey intelligence

Discover how Alterian’s Journey Insight reveals the 70–90% of customer journeys brands can’t see—transforming hidden behavior into actionable intelligence.

Journey Insight 101: How to use journey intelligence

Discover how Journey Insight reveals the full digital customer journey across brands. Explore key features to unlock visibility, competitive context, and actionable intelligence.

Mastering customer journey management in 2025

Learn how to overcome roadblocks and prove ROI for essential journey management, maximize the potential of customer journeys, and deliver exceptional customer experiences.