Banks are losing control of the customer journey with AI search

Key takeaways

Banks directly influence less than 30% of the customer journey today.

Nearly 68% of banking searches are non-branded, and AI answers increasingly replace clicks, making traditional SEO and owned-channel strategies insufficient.

Market-level visibility is now a requirement to optimize for AI visibility, cross-brand comparison, and external touchpoints.

The customer journey goes well beyond your brand

Banks are losing loyalty (and visibility)

In personal banking, where trust and loyalty once meant decades-long relationships, a seismic shift is underway. Modern consumers move fluidly across multiple brands, entering and exiting your digital ecosystem through touchpoints you don't control. The data reveals an uncomfortable truth: even when customers visit your website, most of their journey happens elsewhere.

Your brand owns less than 30% of the customer journey.

The other 70%+ belongs to everyone else.

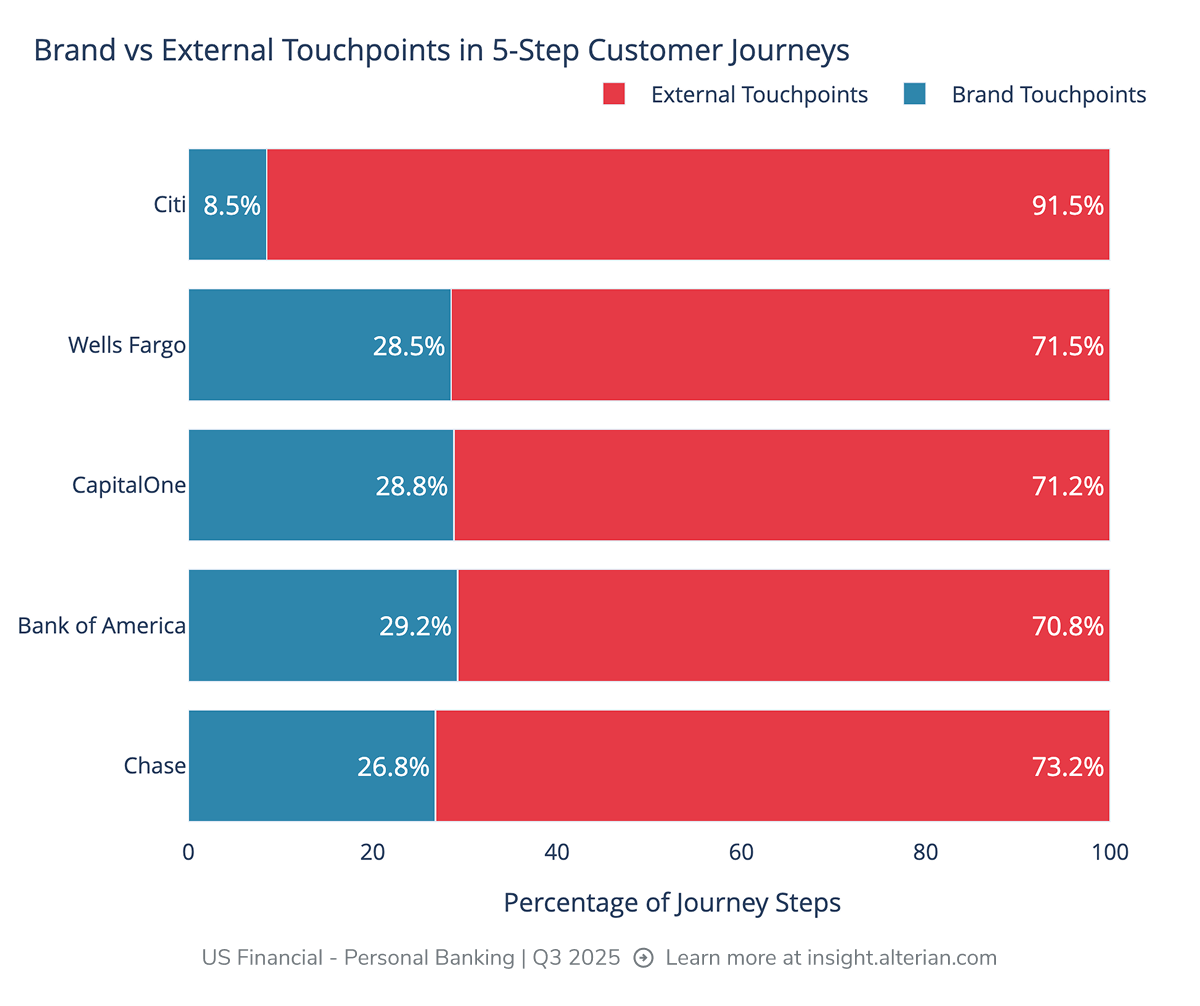

Analysis of brand influence in personal banking journeys

When we analyzed just five-steps of the overall digital journeys in personal banking, we discovered that leading brands like Chase, Bank of America, and Wells Fargo influence an average of just 27-29% of customer touchpoints. Even among their own visitors, brands appear in only about one in four steps of the journey.

The dominant player, Chase, controls just 26.8% of touchpoints in journeys centered on their website. Bank of America and CapitalOne fare slightly better at 29.2% and 28.8% respectively, but the pattern is clear: external forces dominate the modern banking journey.

Note: This analysis examines only five steps of the overall digital customer journey. When viewing the complete journey in Journey Insight, brand influence percentages are even lower.

Cross-brand shopping has become the norm, not the exception

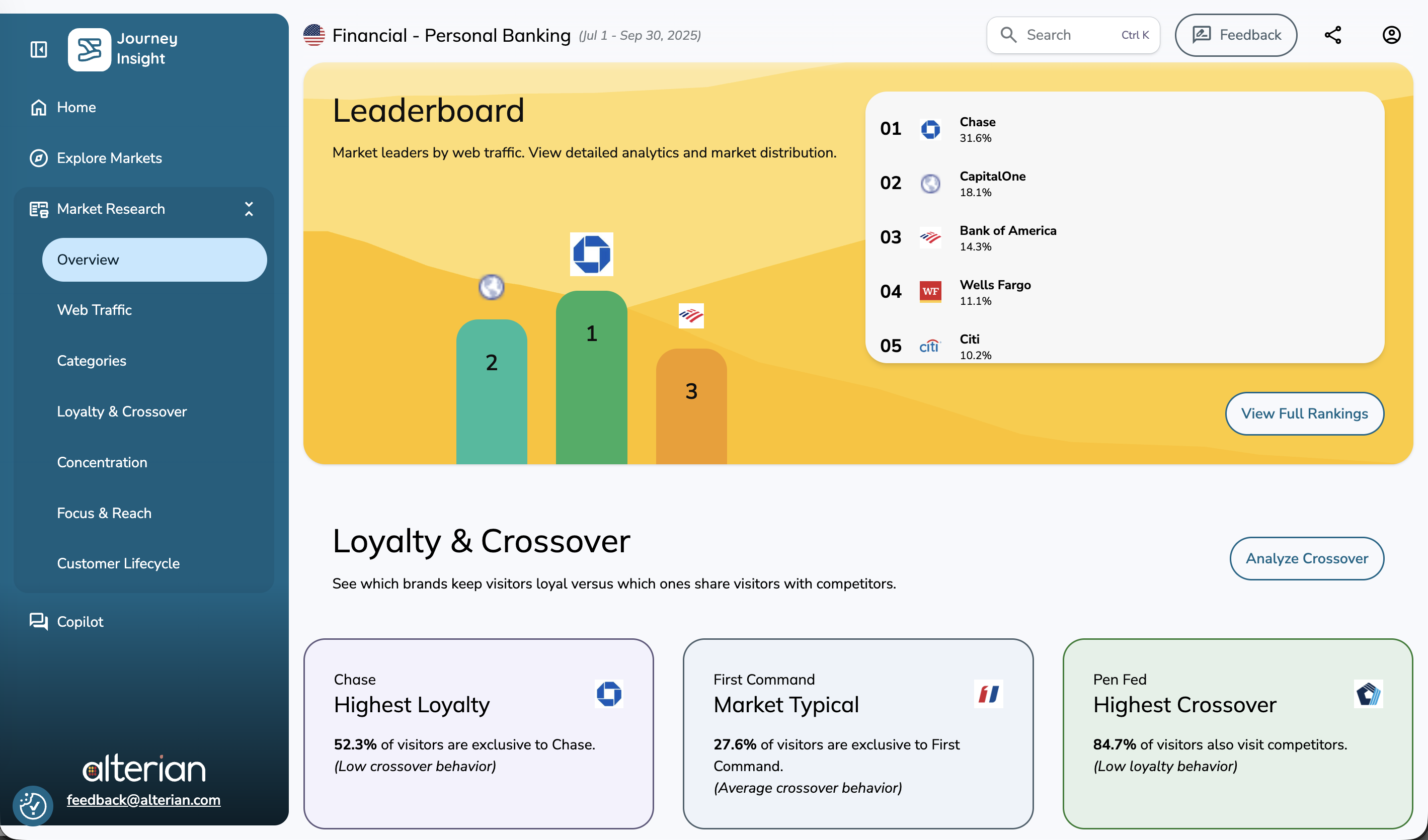

Today's banking customers don't operate in silos. They compare, research, and evaluate across multiple providers simultaneously. Among Chase visitors, over 87% also visit at least one competing bank during their journey. More than half actively engage with two or more competitors.

Customers visiting CapitalOne have a 40.7% likelihood of also visiting Chase. Bank of America visitors show 23.5% overlap with Chase. The data reveals a market where exclusive brand relationships are increasingly rare, and consumers treat banking as a portfolio of options rather than a single relationship.

This behavior pattern creates a critical challenge: your marketing must not only attract customers, but also retain their attention across a journey filled with competitive alternatives at every turn.

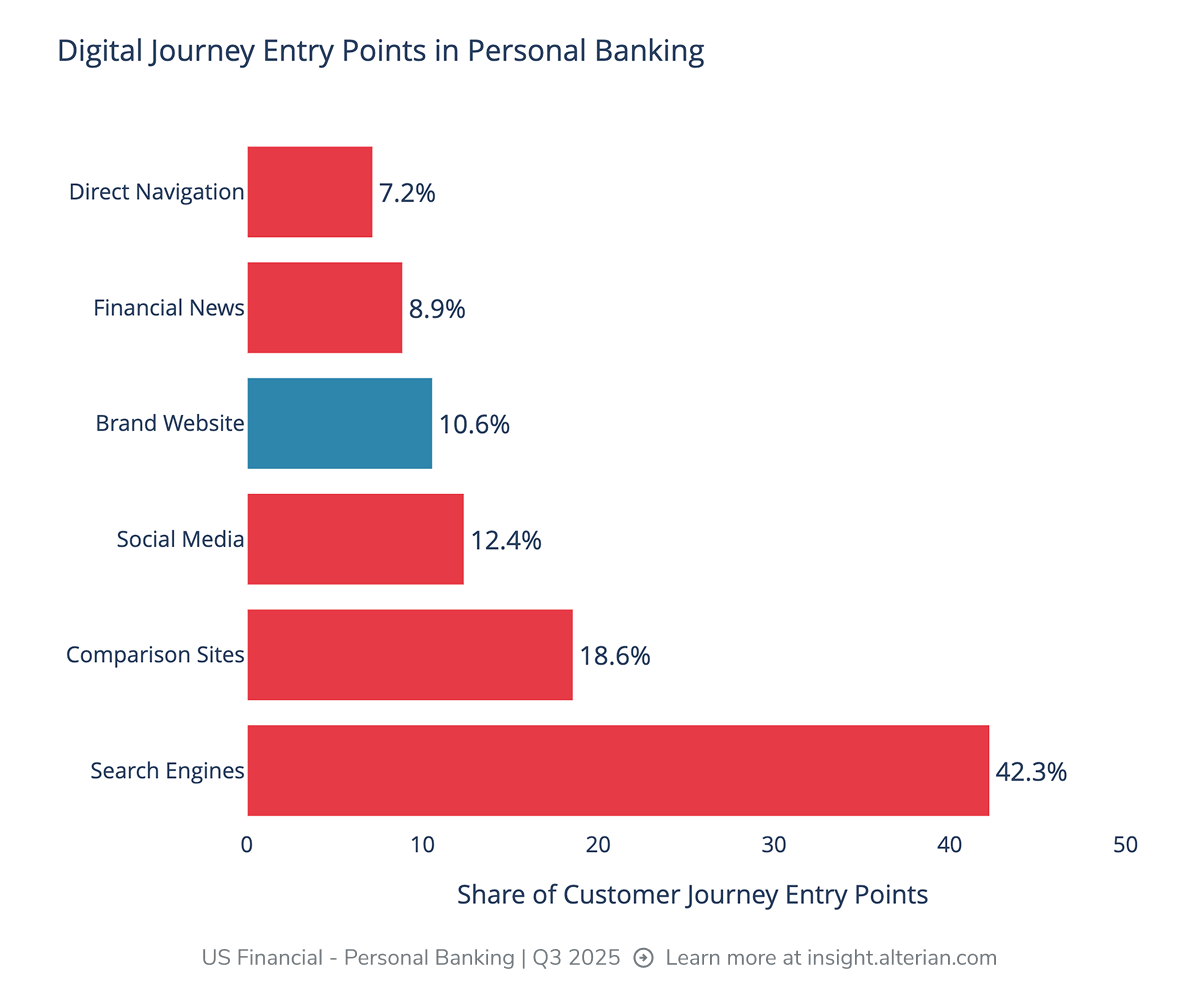

What is driving traffic for personal banking?

Perhaps most concerning for brand marketers is where consumers actually spend their journey time. Search engines alone account for over 42% of journey entry points in personal banking. Google dominates with 40.1% of all referral traffic, while Bing and Yahoo collectively add another 10%.

But here's the accelerating problem: 67.6% of searches that lead to banking sites are non-branded queries. Customers aren't searching for "Chase login" or "Bank of America savings." They're asking questions: "best high-yield savings account," "lowest mortgage rates," "how to improve credit score." They're seeking answers, not brands.

Comparison sites, financial news platforms, and social media channels collectively represent another 40% of touchpoints. These are environments where brands compete on equal footing, messaging is fragmented, and the narrative is often controlled by third parties, algorithms, or peer reviews rather than brand storytelling.

Key emerging trends for marketers

The modern banking marketer faces a fundamental dilemma: how do you build relationships and drive conversions when you only control a fraction of the customer experience?

Traditional marketing strategies focused on owned media, brand websites, and direct customer relationships. But when the overwhelming majority of the journey happens outside your brand ecosystem, this approach leaves massive blind spots. You're optimizing for the 30% you can see while ignoring the 70% that actually determines customer decisions.

Generative Engine Optimization (GEO) and zero-click search

AI-powered search results from ChatGPT, Google's AI Overviews, and Perplexity are fundamentally changing how consumers discover information. When someone asks an AI "which bank has the best savings rates," the AI synthesizes information from across the web and delivers an answer without sending the user to any brand website. Your brand may be mentioned, compared, or overlooked entirely, and you won't know it happened. Traditional SEO metrics become meaningless when the search never generates a click.

AI-driven comparison shopping

Consumers increasingly use AI assistants to evaluate financial products, compare features, and make recommendations. These tools aggregate data from multiple sources, apply logic customers might not use themselves, and present conclusions that bypass traditional brand marketing entirely. A customer might ask "which bank is best for small business owners in California" and receive a synthesized recommendation that considers factors your brand messaging never addresses.

How to adapt your marketing to modern consumer behavior

The solution requires a fundamental shift in perspective. Instead of trying to pull customers into your world and keep them there, successful brands must learn to meet customers where they already are. This means:

Understanding the external touchpoints that matter most in your market and ensuring your brand appears credibly and consistently across them

Building GEO strategies that position your brand as the authoritative source AI systems cite when answering customer questions

Creating structured content that AI can parse, understand, and reference accurately

Developing search strategies that anticipate comparison shopping behavior and zero-click scenarios

Establishing partnerships with the platforms and publishers that shape customer perception

You can't optimize what you can't see

It also means investing in market-level visibility. Brands that win in this environment are those that can see and understand the entire customer journey—not just the portions that touch their owned properties—and understand how both human and AI intermediaries shape customer decisions.

Catching up to the consumer in the AI era

The gap between brand control and customer behavior is widening, not shrinking. As consumers become more digitally sophisticated, more comfortable with AI assistants, more price-sensitive, and more willing to navigate complex financial decisions independently, brand influence will continue to erode unless marketers adapt.

The brands that thrive will be those that embrace a new reality: the customer journey is no longer a path to your door. It's a complex, multi-brand expedition where your brand is just one of many stops along the way, and where AI increasingly serves as the guide. Your goal isn't to own the journey but to be indispensable within it, to provide value at the moments that matter, to ensure AI systems accurately represent your offerings, and to remain relevant even when customers are actively considering your competitors.

Traditional marketing tactics don't work as well as they used to

This requires moving beyond traditional campaign metrics and conversion funnels. It demands understanding competitive dynamics, identifying the moments when customers move between brands, recognizing the external forces that shape perception more powerfully than your own messaging, and adapting to a world where answers increasingly matter more than brands.

Marketers now need to optimize for AI visibility alongside traditional search. The data proves that customers are already using both, often simultaneously, and making decisions in environments you don't control. It's critical to adapt your strategy to match how customers actually behave today, not how they behaved five years ago.

See journeys beyond your brand

This analysis represents only a glimpse: just five steps in what is often a 20, 30, or 50-step journey. The full picture reveals even more extensive external influence and even smaller brand footprints.

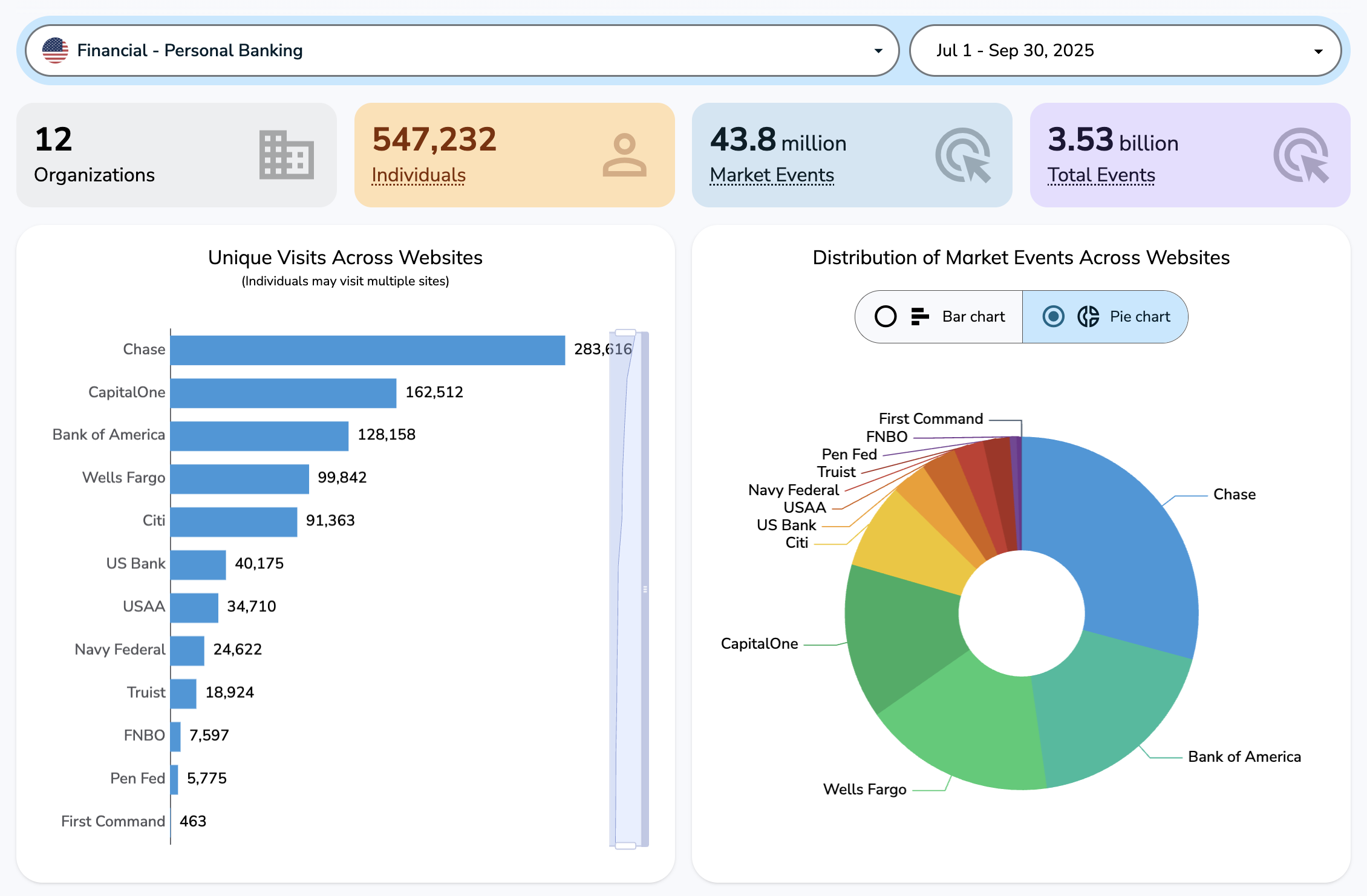

Journey Insight offers market-wide insights in minutes

Journey Insight enables you to map these complete journeys, understand where your brand fits within the broader market ecosystem, and identify the external touchpoints, both human and algorithmic, that truly drive customer behavior.

Use Insight Copilot to dig into the data

Want to continue exploring this topic in Journey Insight? Here's a prompt you can use in Insight Copilot to get started:

The question isn’t whether your brand controls the journey—the data shows it doesn’t.

The real question is what you’ll do now that you can see where your customers actually spend time, and how they discover and compare competitors across channels you may not be tracking.

Get free insights on your customer journeys

Sign up for our robust Free Plan in just a few minutes.

See the latest CX insights

Hospitality brands can't see 85% of the customer journey

Travel & leisure analytics only show 15% of the customer journey. See how travelers move across OTAs and competitors—and how Journey Insight reveals what your dashboards can’t.

The new era of journey intelligence

Discover how Alterian’s Journey Insight reveals the 70–90% of customer journeys brands can’t see—transforming hidden behavior into actionable intelligence.

Journey Insight 101: How to use journey intelligence

Discover how Journey Insight reveals the full digital customer journey across brands. Explore key features to unlock visibility, competitive context, and actionable intelligence.